- Dropbox announced its second-historically speaking income as an open organization on Thursday.

- The organization beat Wall Street’s desires on income and profit per share.

- Be that as it may, the stock slid on news of Chief Operating Officer Dennis Woodside’s looming flight.

Dropbox shares fell Thursday following blended news in its Q2 2018 profit articulation.

The organization detailed a beat on both income and profit per share in its second profit report ever as an open organization.

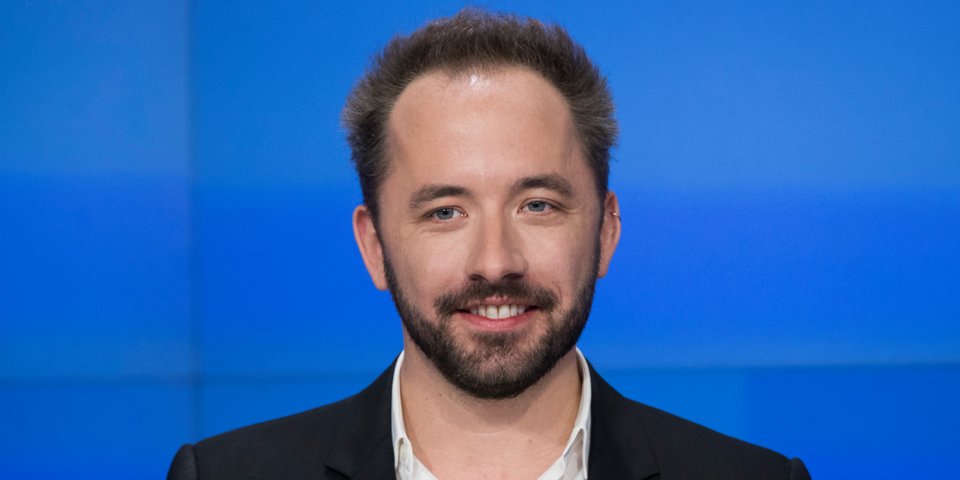

However, it likewise unveiled an unforeseen official takeoff: Chief Operating Officer Dennis Woodside, since quite a while ago considered a key lieutenant to CEO Drew Houston, is leaving the organization. He will remain at Dropbox through early September, and will remain a counsel through the finish of 2018.

His takeoff relates with Dropbox’s bolt up period for workers, which manages how soon they can offer their stock after an organization opens up to the world. The bolt up period closes August 23.

Rather than supplanting Woodside with another COO, Dropbox will rebuild its official group to convey his obligations, the organization says. Yamini Rangan, at present VP of business technique and activities, was elevated to boss client officer. Lin-Hua Wu, VP of correspondences, will keep her title yet report specifically to Houston.

Here’s what Dropbox reported:

Revenue for Q2 (GAAP): Dropbox reported $339.2 million, up 27% from the year before. Analysts expected $330.9 million.

Earnings per share Q2 (adjusted): Dropbox reported earnings per share of $0.11. Analysts expected $0.0.7.

Paying users: The total number of paying users on Dropbox grew by 2 million from last year, up to 11.9 million. The average revenue per paying user is $116.66, up from $111.19 last year.

Net loss (GAAP): Dropbox reported a net loss of $4.1 million, compared to $26.8 million lost in the same period last year.

Revenue guidance for Q3 2018 (GAAP): Dropbox expects to see $350 million to $353 million revenue. Analysts expect $345.9 million.

Earnings per share guidance for Q3 2018 (adjusted): Dropbox did not give guidance for EPS in Q3 but analysts expect $0.07.

Revenue guidance for fiscal 2018 (GAAP): Dropbox expects to see $1.366 billion to $1.372 billion. Analysts expect $1.36 billion.

Operating margin guidance for fiscal 2018 (adjusted): 9.5% to 10.5%

Free cash flow guidance for fiscal 2018: $340 million to $350 million

Original article by Becky Peterson